At a March 12th meeting, Dewey Beach’s Finance Committee reviewed the town’s investment policy implementation plan and discussed what to do with an additional $1.4 million in operating funds currently held at Brown Advisory.

Balancing Risk and Return

Commissioner Paul Bauer raised concerns about whether the town’s current approach is too conservative now that it’s managing millions instead of thousands.

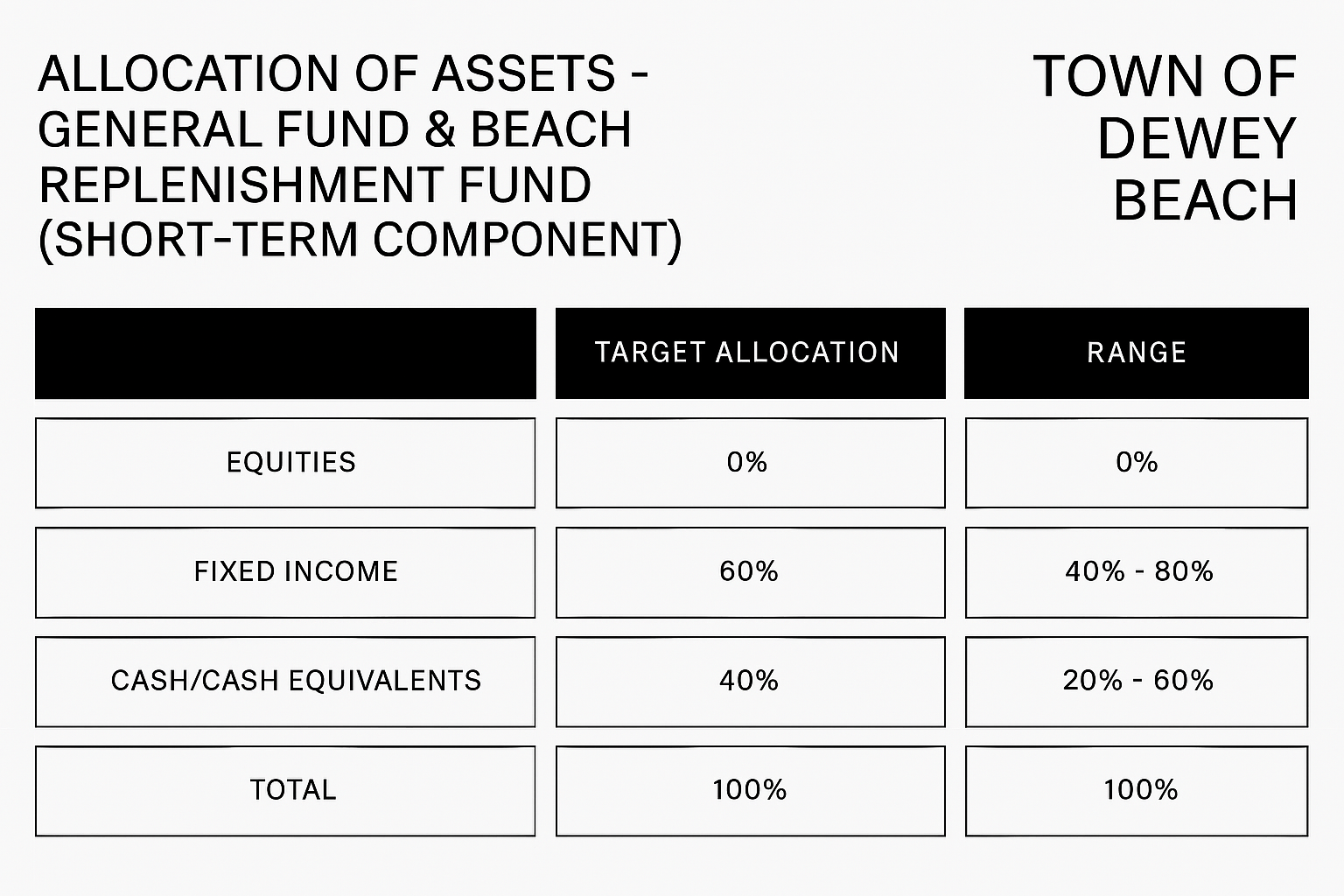

The current policy allocates:

- Short-term funds: 60% to fixed income, 40% to cash/cash equivalents

- Long-term funds: 70% to fixed income, 30% to equities

To ensure better returns without increasing risk, the committee voted to request an analysis from Brown Advisory on potential low-risk alternatives.

They also plan to evaluate whether their current asset allocations are within a healthy balance.

Where to Park the $1.4 Million?

A major discussion point centered on whether the town should keep the extra $1.4 million at Brown, where it earns 1.1% to 1.3% interest, or move it to a sweep account at Community Bank, which offers a guaranteed 4% return.

- Some officials, including Town Manager Bill Zolper, favored the switch, noting the transfer would carry no FDIC risk

- Committee member Eric Nelson preferred keeping the funds at Brown if it could offer similar sweep accounts

- The money might also be used soon to help fund a new town hall and public safety building, so timing is also a factor

The committee will gather more information before making a recommendation, including reviewing contracts with Community Bank and checking Brown’s sweep options.

A change in the town’s investment policy may be needed if the funds are reallocated.

Budget and Public Communication

The committee also discussed the town’s ongoing budget development and public misconceptions about its financial situation.

- Dewey doesn’t collect any property taxes, and must find other revenue sources

- Increases in parking fees have been unpopular, but seemingly necessary

- Members proposed snapshot reports to educate the public on the town’s real financial picture

There was beginning dialogue of proposing a future referendum to raise the accommodations tax, currently at 3%, to bring it in line with similarity with neighboring towns.

Get Involved

Stay informed about how Dewey Beach is managing its finances and planning for the future. Follow our blog and share your thoughts on what you think the town should prioritize!

Source: Cape Gazette